U.S. corporate bankruptcies are rising in 2023, with the first two months of the year registering the highest total for any comparable period since 2011, according to S&P Global Market Intelligence data.

Companies filed 57 bankruptcy petitions in February, while 54 were filed in January. February's total was the most in a single month since March 2021.

The high monthly bankruptcy counts in 2023 follow a historically slow year in 2022. Many bankers and analysts expect a downturn in the economy in 2023 that may prompt additional bankruptcy filings. S&P Global Ratings, meanwhile, expects an uptick in defaults for the lowest-rated corporate borrowers in 2023 due to added stress from contracting corporate earnings, higher unemployment and tighter monetary policy.

"Interest rates remain elevated with little reason to suspect they will decline meaningfully by year-end, adding to increased costs for firms," Nick Kraemer, head of ratings performance analytics at S&P Global Ratings, said in a Feb. 16 report.

Prominent filings

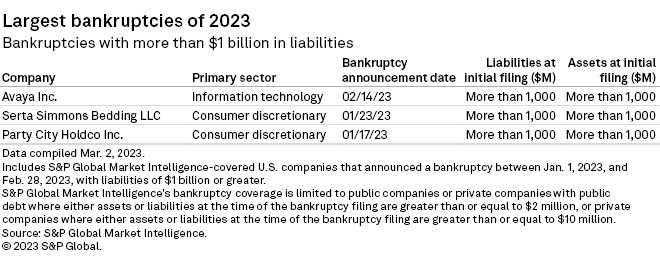

Communications equipment company Avaya Inc. marked the largest corporate bankruptcy filing in February, listing both liabilities and assets at more than $1 billion.

Biotechnology-focused Sorrento Therapeutics Inc. also filed for Chapter 11 bankruptcy Feb. 13, with liabilities listed in the range of $100 million to $500 million and assets at more than $1 billion.

* Download the charts in Excel format.

* For retail-specific bankruptcy data, check out the monthly Retail Market series.

A third noteworthy filing during the month included NBGHome, which listed liabilities at $676.6 million and assets at $739.1 million.

Avaya's recent filing marked the third U.S. corporate bankruptcy filing year-to-date with liabilities above $1 billion, the other two being Serta Simmons Bedding LLC on Jan. 23 and Party City Holdco Inc. on Jan. 17.

Consumer discretionary leads filings

The consumer discretionary sector had the most filings year-to-date at 17. The industrials and healthcare sectors followed next at 10 and nine, respectively, while the financials and information technology sectors had seven each.

Editor's note: This Data Dispatch is updated on a regular basis. The last edition was published Feb. 2.

Bankruptcy figures include public companies or private companies with public debt with a minimum of $2 million in assets or liabilities at the time of filing, in addition to private companies with at least $10 million in assets or liabilities. Market Intelligence may remove companies from this list if it discovers that their total assets and liabilities do not meet the threshold requirement for inclusion.